Track Your Gig Income Like a Pro

Whether you drive for Uber, Lyft, DoorDash, or any other gig platform, Ride Income Calculator helps you track your earnings, expenses, and hourly rate with precision. Here’s how it works—and why it matters.

Log Your Daily Stats

Each day, enter your trips, distance, driving hours, earnings, tips, and fuel costs. The dashboard updates instantly to show your real hourly rate.

Track Expenses

Log oil changes, tire replacements, repairs, and other vehicle costs. These help you understand your true net income and prepare for tax season.

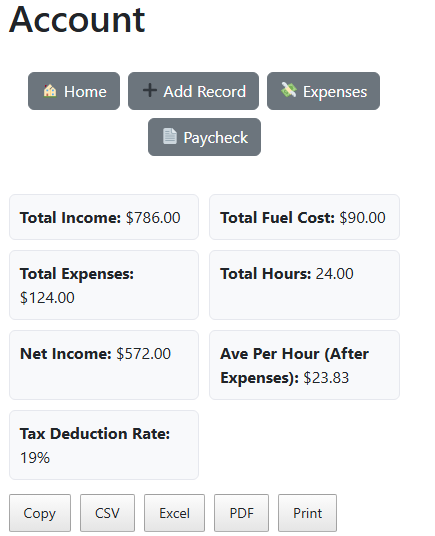

View Your Dashboard

See your net income, total hours, and hourly rate in real time. Filter by date, export your data, and spot trends that help you earn more.

Set Your Tax Deduction Rate

Customize your deduction rate to see how taxes affect your take-home pay. Use this to plan ahead and avoid surprises.

Export Your Data

Download your ride logs in CSV, Excel, or PDF format using built-in export tools. Perfect for tax prep or financial planning.

Built for Drivers, by a Driver

This isn’t a generic startup tool—it’s built by someone who understands the grind. Ride Income Calculator is fast, private, and focused on what matters.